If you use online bill paying services, are a lover of debit cards, or write manual checks rather than print them directly out of QuickBooks, and wish to save precious time posting transactions into QuickBooks, then you might wish to consider downloading the transactions that have already cleared your bank account directly into QuickBooks, obviating the need to entering each transaction into. QuickBooks automatically downloads the latest available transactions every night around 10 PM PT (UTC-8:00). For most banks, transactions are usually available for QuickBooks to download the day after they post to your bank's website. Canon imageformula dr-c125 user manual driver. Some may take a little longer depending on your bank. You can also do a manual update to get the latest. Manually download transactions for quickbooks online. My bank is not a direct connect. How do I manual download transactions into quickbooks online? Cambridge audio azur 540r.

- Manual Bank Download On Quickbooks Online 2017

- Quickbooks Training Manual Free Download

- Quickbooks Online Reference Manual

by William Brighenti, Certified Public Accountant, Certified QuickBooksProAdvisor

If you use online bill paying services, are alover of debit cards, or write manual checks rather than print themdirectly out of QuickBooks, and wish to save precious time postingtransactions into QuickBooks, then you might wish to considerdownloading the transactions that have already cleared your bankaccount directly into QuickBooks, obviating the need to entering eachtransaction into QuickBooks. This can be a real time saver. Moreover, by downloading these transactions directly into QuickBooks,you can minimize the possibility of errors resulting from inputtingincorrect dollar amounts, since a direct download prevents suchmispostings. Furthermore, it can assist in ensuring that yourQuickBooks records are always up-to-date, rather than waiting for yourbookkeeper to enter the transactions at a later date. Overdraftfees are not cheap, and can accumulate quickly into hundreds ofdollars. So here is a convenient way to keep your books currentwith little effort and expense.

If you have not already set up online banking services with your bank,you may be able to do so via QuickBooks. To get started, Go toBanking>Online Banking>Set Up Account for Online Services. The following dialog box then appears:

Simply select your bank account as it appears in your chart ofaccounts. (If it is not set up yet, select “New” and follow theinstructions in the screens that appear.) After you select“Next”, select the name of your bank under “Enter the name of yourFinancial Institution”. (If it is not included in the list offinancial institutions, your bank may be one of those rare banks notoffering QuickBooks online banking; you would be well advised to callthe bank to verify such.)

QuickBooks then updates your financial institution’s information byconnecting via the internet.

At this point, depending upon your financial institution and itsprocedures for QuickBooks online banking, before proceeding further youmay be required to download a bank statement from your financialinstitution’s online banking portal as a security measure to confirmyour ownership of the account. If so, click “Go to My Bank’s Website” and QuickBooks automatically connects you to your bank’s webpagewhere you can log in. Select your account and locate the optionentitled Export, Download, or Send your transactions. You may bequeried as to which file format you prefer: select QuickBooks or.QBO or the appropriate version of QuickBooks that you are using,etc. Then select the date range of the transactions you wish todownload.

After you selected the exporting of your data, your bank then asks ifyou wish to “Open” or “Save” the file. Click “Open” to import thetransactions now; click “Save” to do so later. After QuickBooksreceives the data, it, too, asks whether you wish to import it now orsave the file for a later time. Select “Import new transactionsnow”.

A dialog box then appears asking in which bank account you wish thetransactions to be imported. Select the appropriateaccount. Once again, if the bank account does not exist, you cancreate it now without leaving Online Banking. If the account hasalready been set up, select it and click “continue”. QuickBooksshould then notify you that the data has been successfully “read” intoQuickBooks and that you can view your downloaded data in Online BankingCenter by selecting your Financial Institution.

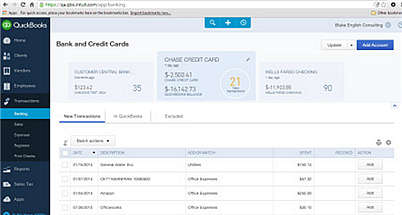

You then are offered a choice to view and enter your downloaded datainto QuickBooks by either the Side-by-Side Mode or the RegisterMode. The Side-by-Side Mode presents two screens, one on the leftshowing the recently downloaded data from the bank, the other on theright showing transactions recorded in QuickBooks but “opened” or nothaving been designated as clearing the bank yet, facilitating the entryof unrecorded transactions and precluding the error of duplicatingpostings in QuickBooks. The Register Mode presents the bank datain the bank register format of QuickBooks, the bank register on top,and the downloaded bank data below. Click “yes” to choose theSide-by-Side Mode since most users find it easier with which to work,unless you prefer the Register Mode, which was the only available modein QuickBooks prior to 2009.

At this point QuickBooks shows a screen showing the number oftransactions received. After your first download, QuickBooks onlyloads transactions not previously downloaded in order to minimize therecording of duplicate transactions. Here you have theopportunity of viewing all of the downloaded transactions before addingthe transactions to QuickBooks. If all appears in order, select“Add transactions to QuickBooks”.

The next screen is the side-by-side mode screen showing you all of thedownloaded transactions and summarizing the number matched andunmatched. On the left side, if you highlight a check thatdisplays an “Unmatched” status, the “Record an Expense” screen appearson the right side.

Click “More” in the upper right hand corner of the screen, and if yoususpect that the amount was recorded but for some reason QuickBooks wasunable to match it for various reasons, select “Match to an existingQuickBooks transaction” underneath “Record an Expense”; otherwise,select “Record an expense in QuickBooks”, allowing you to record theexpense without leaving Online Banking. Click the option, “Showsplits, memo, date, number…” and fill in the appropriate fields,including “Customer: Jobs” and “Class”, if desired.

Since here in this example above there were no matching transactionfound, presuming that the transaction had never been recorded, yousimply can proceed to record the transaction while connected to youronline banking session in QuickBooks.

The process is similar regarding the matching and recording ofdeposits. If QuickBooks indicates the “Status” of thedeposit as unmatched, unless the transaction previously has been postedin QuickBooks incorrectly—for example, as to its amount—then you canrecord it here on the right side in QuickBooks while connected toonline banking. Select “Record a QuickBooks Deposit” at the topand fill in the details below, including customer, account, amount, andany memo needed:

If transactions had been recorded in QuickBooks and the programindicates a match under the “Downloaded Transactions” in the topleft-half side of the window, as below, click “Show” to its right todisplay the details of the transaction and confirm the match:

Now simply click “Confirm This Match” and the transaction is indicatedas having cleared for your bank reconciliation.

Manual Bank Download On Quickbooks Online 2017

As you can see, downloading QuickBooks transactions from your bankstatement can save time and prevent errors; however, you must alwaysexercise care when doing so. That is, you must ensure that yourmatch is indeed a legitimate match. For instance, if you arerecording many transactions of similar dollar amounts and on similardates, as in property management accounting when many rents areidentical in amount and all may be posted on the first of the month,QuickBooks will be unable to distinguish the appropriate vendors orcustomers and will often select the wrong party. While using thismatching feature in QuickBooks, you must always exercise vigilance andcare; otherwise, you may make a complete mess of your records, and notonly negate any time savings from its use, but may incur significantcosts in correcting and recovering your records.This article is provided for informational purposes and isnot intended to be construed as legal, accounting, or otherprofessional advice. For further information, please consultappropriate professional advice from your attorney and certified publicaccountant.

Have a tax, a QuickBooks, or an accounting question? Please feelfree to submitit under 'Comments'

on ourblog, Accounting, QuickBooks, and Taxes byWilliam Brighenti,Certified PublicAccountant, Accountants CPA Hartford, LLC. Forinformationand assistance onany tax, QuickBooks, or accounting issue, please visit ourwebsite: Accountants CPAHartford, LLC

on ourblog, Accounting, QuickBooks, and Taxes byWilliam Brighenti,Certified PublicAccountant, Accountants CPA Hartford, LLC. Forinformationand assistance onany tax, QuickBooks, or accounting issue, please visit ourwebsite: Accountants CPAHartford, LLCQuickbooks Training Manual Free Download

. Please visit our sister website, Intense Flavors,and see how you can have a gourmet meal on us when we do youraccounting, QuickBooks, and taxes.Quickbooks Online Reference Manual

If and onlyto the extent that this publication contains contributions from taxprofessionals who are subject to therules of professional conduct set forth in Circular 230, as promulgatedby the United States Department of the Treasury, the publisher, onbehalf of thosecontributors, hereby states that any U.S. federal tax advice that iscontained in such contributions was not intended or written to be usedby any taxpayer for the purpose of avoiding penalties that may beimposed on thetaxpayer by the Internal Revenue Service, and it cannot be used by anytaxpayer forsuch purpose.The above tax advice waswritten to support the promotion or marketing of the accountingpractice of the publisher and any transaction described herein.The taxpayer recipients of this offeringmemorandum should seek tax advice based on their particularcircumstances from an independenttax advisor.

Wi-Fi & NFC allows remote access from a smartphone/tabletThe Leica V-Lux is a prosumer camera. The 20MP large sensor delivers outstanding image quality. Leica v-lux (typ 114) user manual. It combines the Leica tradition and modern technology at different level. Up to 50fps with Electronic Shutter.